VWAP vs EMA: Which Is Better for Day Trading?

Introduction

In the world of day trading, VWAP and EMA are two of the most popular technical indicators. Both help traders make sense of price trends, but they serve different purposes. In this guide, we’ll compare VWAP vs EMA, so you can decide which is better for your trading style.

What is VWAP?

VWAP (Volume Weighted Average Price) calculates the average price an asset has traded throughout the day, weighted by volume.

- Resets daily

- Used by institutional and intraday traders

- Acts as a dynamic support/resistance level

What is EMA?

EMA (Exponential Moving Average) is a type of moving average that puts more weight on recent price data.

- Smooths out price action

- Reacts faster than SMA

- Commonly used for trend identification and crossovers

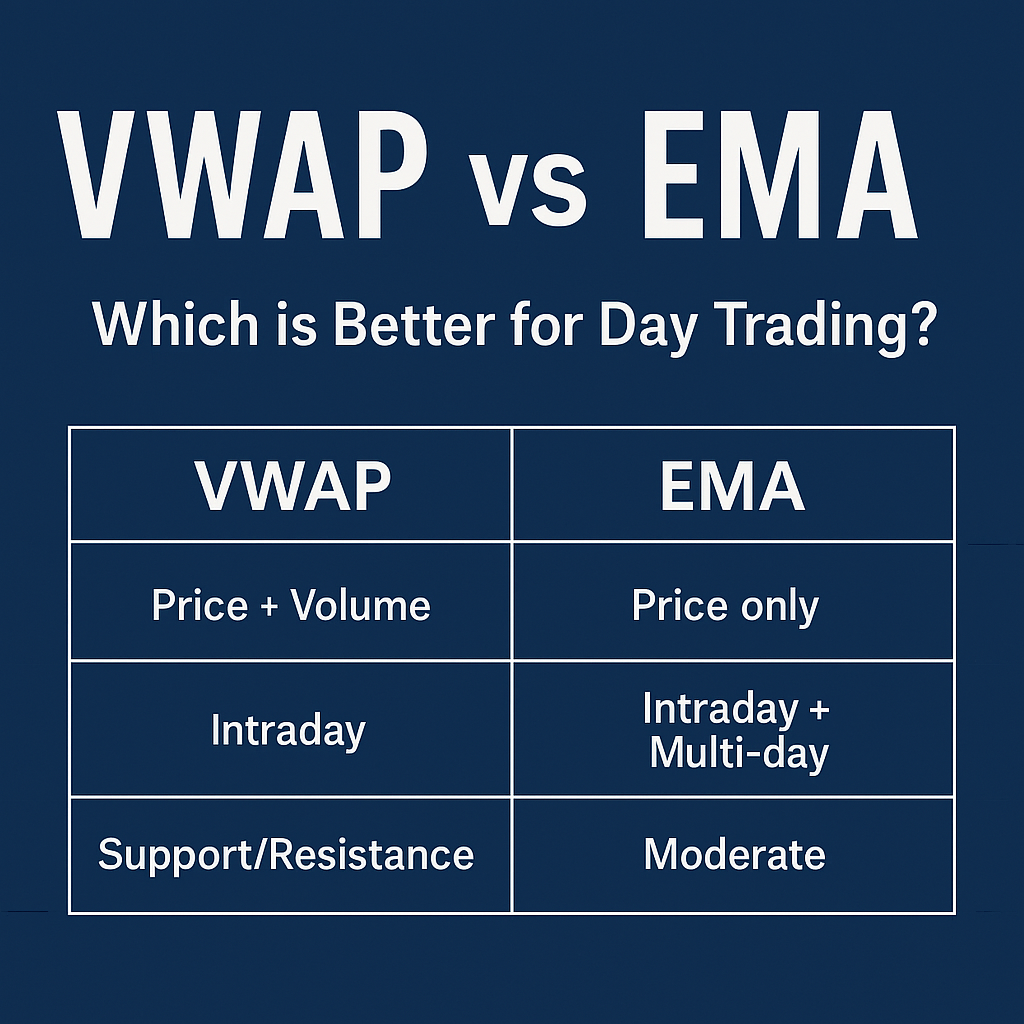

Key Differences Between VWAP and EMA

| Feature | VWAP | EMA |

|---|---|---|

| Data Used | Price + Volume | Price only |

| Use Case | Intraday | Intraday + Multi-day |

| Reset | Daily (intraday) | Continuous |

| Institutional Use | High | Moderate |

| Support/Resistance | Strong | Moderate |

| Timeframe | Short-term | Any timeframe |

When to Use VWAP

- When trading intraday

- For spotting entry/exit points

- To identify whether price is overvalued or undervalued

When to Use EMA

- To determine overall trend direction

- For crossover strategies (e.g., 9 EMA vs 21 EMA)

- To confirm breakouts or reversals

Can You Combine VWAP and EMA?

Yes! Many traders use both for better confirmation.

Example Setup:

- Use VWAP for market bias (above = bullish)

- Use EMA crossover for trade timing (e.g., 9 EMA crosses above 21 EMA)

Which One is Better for Day Trading?

It depends on your strategy:

- For price value and volume-weighted insight → VWAP wins

- For trend-following and momentum → EMA is better

Use both for the best of both worlds.